Internal vs External Audit: Differences and Use Cases

Audits can feel overwhelming, but they are essential for keeping your business on track. Whether it's an internal audit or an external one, both play a key role in ensuring your operations are efficient and compliant.

But what's the difference between the two, and when should you use them?

In this article, we’ll break down the characteristics of internal and external audits, explain how they work, and explore which type of audit is best suited for different situations.

At a glance: Internal vs external audits

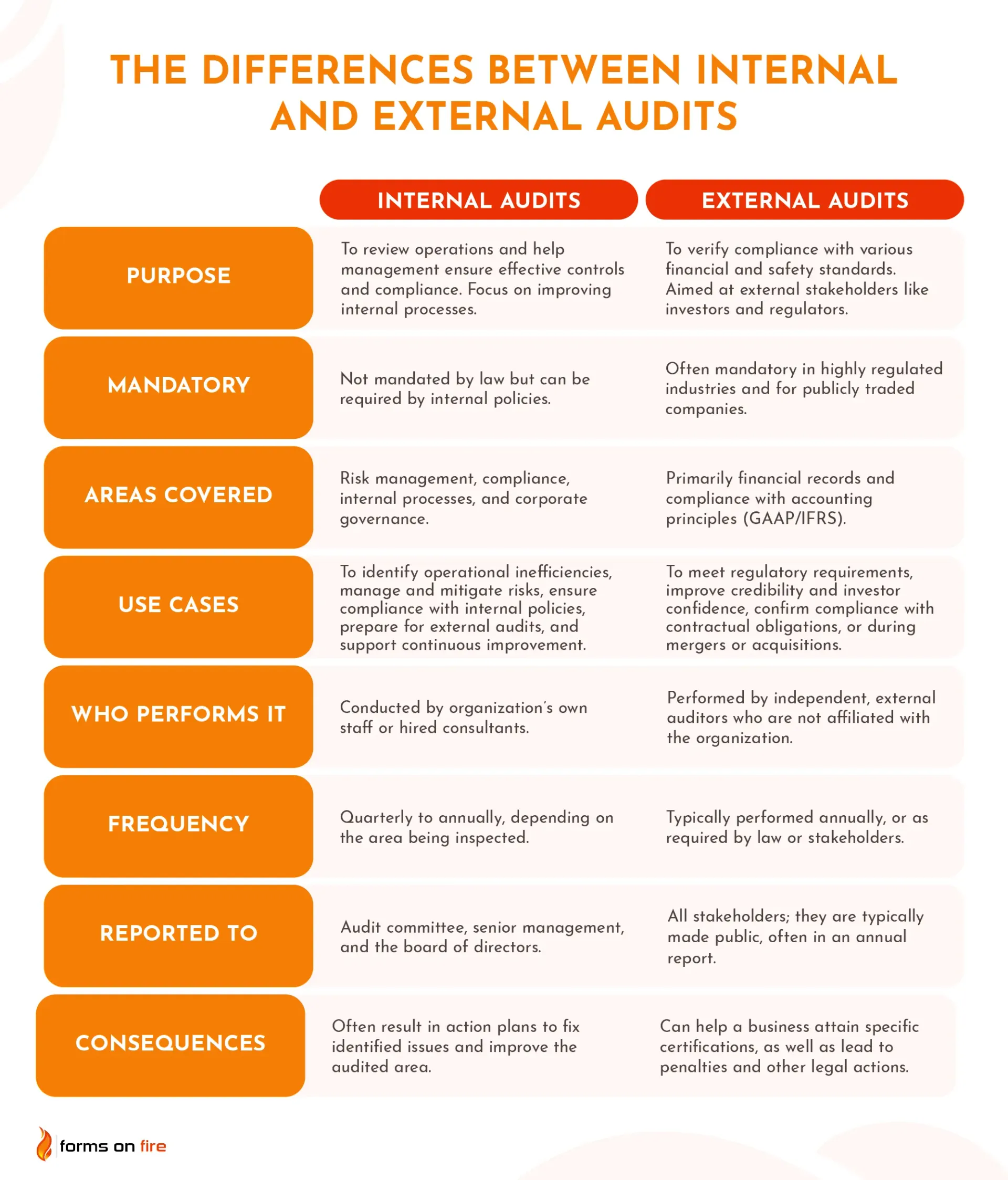

The main difference between an internal audit and an external audit comes down to who performs the audit and what the goal is.

Internal audits are conducted by a company’s own staff to evaluate and improve internal processes, while external audits are performed by third-party auditors to provide an independent review of financial statements or compliance.

In essence, they serve different purposes — internal audits help companies stay on track, and external audits offer an objective, outside perspective to meet regulatory or stakeholder requirements.

Since they have different goals, their implementation can vary significantly. The graphic below tries to summarize all of the main differences.

Before we outline when to use each, let’s take a closer look at these two types of audits separately.

The characteristics of an internal audit

An internal audit is a self-evaluation process that helps a company assess its operations, controls, and processes. It is designed to identify potential risks, uncover inefficiencies, and drive continuous improvement.

Internal audits are typically performed by employees within the organization — often on a recurring basis — to ensure that internal policies and procedures are being followed.

To streamline internal auditing, companies can use tools like Forms On Fire to build customized checklists and data collection forms. This also helps standardize the process, simplifying the comparison with past audit findings.

Types and examples of internal audits

There are several types of internal audits, each focused on a specific area of the business. Below are the most common examples:

- Financial audits: Focus on the accuracy and integrity of financial records, including revenue, expenses, and balance sheets. The goal is to ensure all financial reporting is correct and complies with internal policies.

- Operational audits: Assess the efficiency and effectiveness of day-to-day operations. These audits help identify any waste, bottlenecks, or areas where productivity can be improved.

- Compliance audits: Ensure the organization is following internal policies, industry regulations, and legal requirements. This type of audit helps mitigate risks associated with non-compliance.

- IT audits: Review the security and integrity of an organization's IT systems. IT audits help ensure that data is secure, access controls are in place, and technology is being used effectively.

- Integrated audits: These audits can combine elements from financial, operational, compliance, and IT audits to provide a more comprehensive review of the organization’s processes and controls.

The consequences of internal audits

Internal audits are typically reported to management and key stakeholders within the company. The findings often come in the form of a detailed report that highlights any issues, inefficiencies, or risks discovered during the audit. This report may also include recommendations for improvements and a proposed timeline for addressing any identified weaknesses.

The outcomes of an internal audit can vary. If significant issues are found, the company may need to implement corrective actions, such as updating internal controls, refining processes, or providing additional employee training. In some cases, recurring problems can lead to more frequent audits or the involvement of external auditors for a deeper investigation.

Typical next steps after an internal audit include scheduling follow-up reviews to ensure that recommended changes are being implemented and are effective.

The characteristics of an external audit

An external audit is an independent, objective review conducted by a third-party auditor, usually a certified public accounting (CPA) firm. The main purpose of an external audit is to validate the accuracy of a company’s financial statements or to ensure compliance with various regulatory standards.

Unlike internal audits, which are ongoing and more flexible, external audits are typically performed annually — or as required by law or stakeholders (such as investors or regulatory bodies).

The external audit process usually involves a thorough examination of the company’s financial records, controls, and accounting systems. Once completed, the audit results are reported to the company’s leadership and external stakeholders, offering an unbiased opinion on the financial health and compliance status of the organization.

Types and examples of external audits

While financial audits are the most common example, there are other types of external audits:

- Financial audits: The auditor reviews the company’s financial statements to ensure they are accurate and comply with accounting standards like GAAP or IFRS. The goal is to provide an independent opinion on the financial health of the organization.

- Compliance audits: These audits assess whether the company is following laws, regulations, or agreements it is subject to. A company may undergo a compliance audit to verify adherence to environmental regulations (e.g., EPA standards) or industry-specific standards (e.g., OSHA for workplace safety, HIPAA for healthcare data protection).

- Internal controls audits: This type of audit evaluates the effectiveness of a company’s internal controls over financial reporting. External auditors check whether the internal processes in place are sufficient to prevent fraud or errors, and they recommend improvements if necessary.

The consequences of external audits

The results of external audits are usually compiled into a formal audit report, which is shared with company leadership and external stakeholders such as investors, regulatory bodies, or creditors. This report typically includes the auditor’s opinion on the accuracy and fairness of the company’s financial statements, as well as any significant findings or areas of concern.

If the external audit reveals serious issues, such as material misstatements or non-compliance with regulations, the company may face a range of consequences. These can include penalties, fines, or legal actions if regulatory requirements are not met. Additionally, a negative audit report could damage the company’s reputation or lead to a loss of investor confidence, which might impact funding opportunities.

Based on the findings, the company might need to take the appropriate corrective actions — revise financial records, improve internal controls, or address any compliance violations. After the issues have been resolved, the company may need to undergo follow-up audits to confirm that the corrective measures have been effectively implemented.

Internal or external audit: Which is better?

Asking whether internal or external audits are better is the wrong question — they’re not interchangeable, and each serves a different purpose.

Both are crucial for a well-rounded governance strategy. Instead of choosing one over the other, companies should see them as complementary tools that, when used together, provide a comprehensive understanding of business performance, risks, and compliance.

When should you perform an internal audit?

Internal audits are performed when an organization wants to:

- Identify operational inefficiencies: Internal audits help pinpoint areas where resources are being wasted, allowing companies to streamline operations and increase productivity.

- Manage and mitigate risks: Regular internal audits can identify potential risks before they become serious issues, helping organizations proactively address them.

- Ensure compliance with internal policies: If a company has specific policies or procedures in place, internal audits verify that employees are following these standards.

- Prepare for external audits: Conducting internal audits before an external audit can help uncover any problems that need to be fixed, reducing the risk of negative findings from third-party auditors.

- Support continuous improvement: Internal audits provide insights into how processes can be enhanced and aligned with the company’s goals, fostering a culture of ongoing optimization.

When should you perform an external audit?

External audits are typically conducted when an independent review is needed to ensure transparency and accountability. These situations include:

- To meet regulatory requirements: Many industries require external audits to ensure companies are following different laws and regulations.

- To improve credibility and investor confidence: Publicly traded companies or businesses seeking investment often need external audits to provide shareholders and potential investors with assurance that financial statements are accurate and reliable.

- During mergers or acquisitions: When a company is being bought, sold, or merged with another entity, external audits provide a thorough review of financial health, helping both parties make informed decisions.

- To confirm compliance with contractual obligations: Sometimes contracts with lenders, partners, or suppliers require external audits to verify that financial or operational conditions are being met.

Streamline your audits with Forms On Fire

Forms On Fire is a no-code form builder you can use to digitize your auditing procedures, making it easier to track, document, and manage audit findings. You get access to features like:

- Customizable audit forms: Tailor your audit forms to meet specific business needs, ensuring all important areas are covered. If needed, our platform allows you to collect data offline, scan barcodes, and even collect digital signatures.

- Automated workflows: Record and store audit data instantly. Set up automated workflows to assign tasks and track progress, making sure follow-up actions are completed efficiently.

- Cloud storage and reporting: Keep all audit data securely stored in the cloud and easily generate reports for internal teams or external stakeholders.

By using Forms On Fire, you can increase audit accuracy and save valuable time — hitting two birds with one stone.

Want to learn more? Request a demo or start a free trial with Forms On Fire today.