Simplify Compliance Management With the Right Controls and Best Practices

Maintaining compliance is no small feat. From navigating ever-evolving regulations to ensuring internal standards are met, organizations face a range of challenges. The risk of non-compliance — whether it's fines, reputational damage, or operational disruptions — adds even more pressure.

The good news? Compliance management doesn’t have to be a constant struggle.

By implementing the right controls and following proven best practices, businesses can simplify their efforts and stay on the right side of the law while achieving operational excellence.

This article aims to provide actionable insights and strategies to help streamline your compliance management processes.

What is compliance management?

Compliance management is the process of ensuring that an organization adheres to both internal standards and external regulatory requirements. It involves the implementation of policies, procedures, and controls designed to align business operations with relevant laws, regulations, and ethical practices.

Broadly speaking, there are two primary types of compliance:

- Internal compliance: Focused on upholding the organization’s internal standards, values, and policies to maintain integrity and accountability.

- External compliance (regulatory compliance): Concerned with meeting industry-specific regulations and legal obligations — such as data protection laws, financial reporting requirements, or EHS compliance.

Some common regulations businesses must comply with include:

- GDPR (General Data Protection Regulation): Protects personal data and privacy in the EU.

- HIPAA (Health Insurance Portability and Accountability Act): Ensures the confidentiality of health information in the U.S.

- SOX (Sarbanes-Oxley Act): Strengthens corporate governance and financial transparency.

- PCI DSS (Payment Card Industry Data Security Standard): Safeguards payment card data.

- Workplace safety regulations: Enforce standards to ensure employee safety and reduce hazards.

Failing to maintain compliance can lead to severe consequences, including significant financial penalties, reputational damage, and increased operational risks. That’s why businesses need a robust compliance management system.

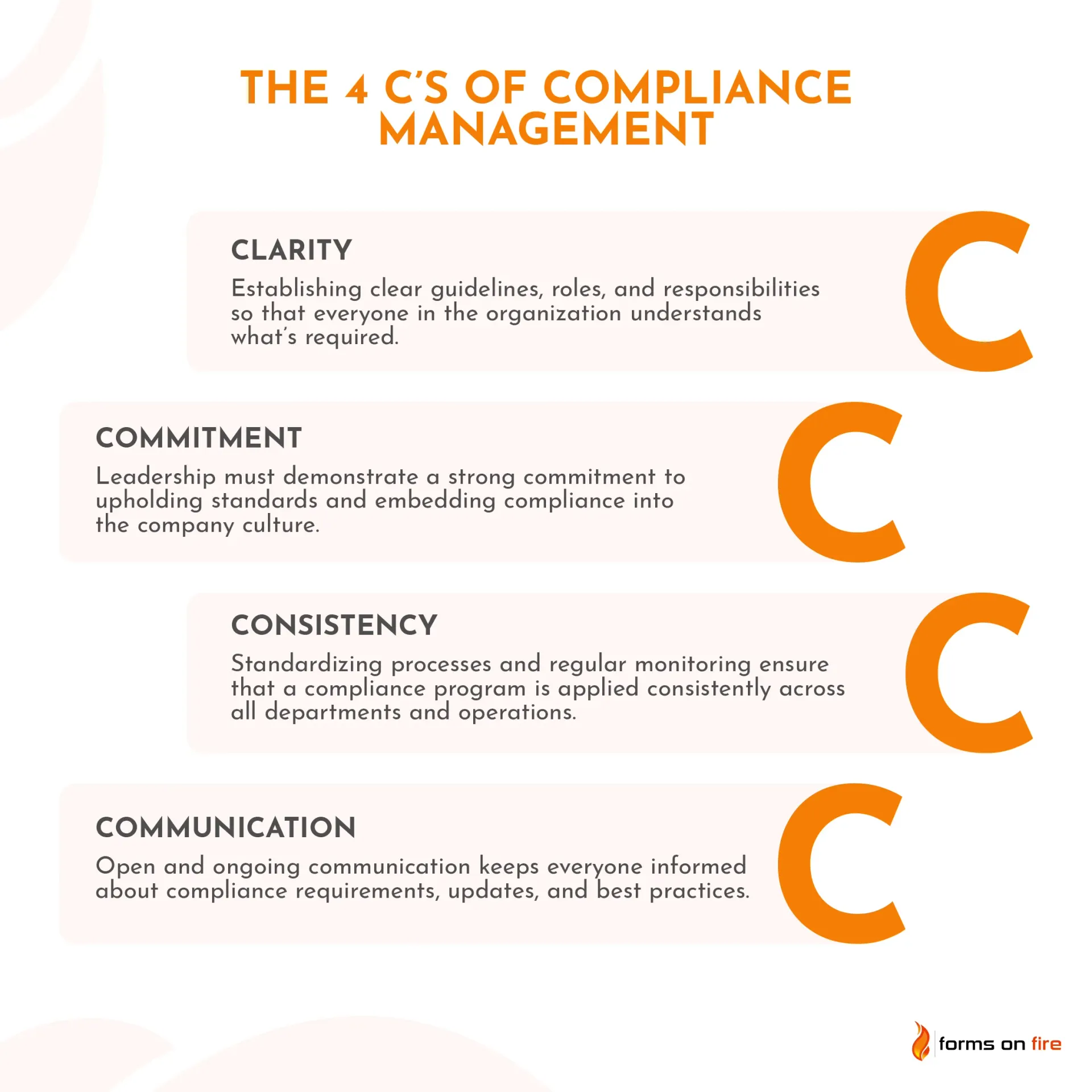

Using 4 C’s to build an effective compliance management program

The 4 C’s of Compliance is a framework that represents the key characteristics of an effective compliance program. They are:

- Clarity: Well-defined compliance standards are the foundation of any successful program. This means establishing clear guidelines, roles, and responsibilities so that everyone in the organization understands what’s required.

- Commitment: Compliance starts at the top. Leadership must demonstrate a strong commitment to upholding standards and embedding compliance into the company culture.

- Consistency: A compliance program is only effective if it’s applied consistently across all departments and operations. Standardizing processes and maintaining regular monitoring are essential to achieve this.

- Communication: Open and ongoing communication keeps everyone informed about compliance requirements, updates, and best practices. Furthermore, regular training and accessible resources make it easier for employees to stay compliant.

By focusing on these pillars, businesses can build a compliance management program that not only meets regulatory standards but also integrates seamlessly into their day-to-day operations.

The result is a proactive approach that minimizes risks and boosts organizational resilience.

Internal controls you can use to simplify compliance management

Internal controls are mechanisms, policies, and procedures designed to ensure compliance with laws, regulations, and organizational standards. They can come in three different forms:

- Preventive controls: Aim to stop compliance issues before they occur, such as access restrictions or approval workflows.

- Detective controls: Identify and flag potential problems, like monitoring or internal audits.

- Corrective controls: Address and resolve issues after detection, such as updating policies or retraining employees.

Here are common internal controls businesses can use:

- Policies and procedures: Establish clear, documented processes for all compliance-related activities. This provides employees with a reliable reference and ensures consistency across the organization.

- Access controls: Manage permissions to protect sensitive information and prevent unauthorized access. This is especially critical for data security compliance.

- Audit trails: Keep detailed logs of all activities and transactions. These records improve transparency and make it easier to identify discrepancies during audits.

- Risk management frameworks: Proactively identify, evaluate, and mitigate compliance risks. This structured approach helps prioritize and address potential vulnerabilities.

- Monitoring and reporting mechanisms: Automate compliance monitoring and reporting to ensure timely, accurate data collection and analysis. Automation reduces human error and enhances efficiency.

While we would like to say you can pick and choose from this list, the reality is that you should implement all of those practices. It is the only path to a robust compliance infrastructure.

Stay compliant by following these best practices

How complicated compliance management is depends on the size of your organization and the industry you operate in.

Large organizations in heavily regulated industries need to follow a set of proven best practices to streamline and simplify their compliance efforts.

Implement compliance software

Technology simplifies compliance management by automating repetitive tasks, improving accuracy, and providing real-time insights. GRC platforms are one such solution, offering a centralized hub to manage policies, monitor compliance, and generate reports.

Automated tools can also handle tasks like:

- Tracking regulatory changes to keep your organization up to date.

- Monitoring compliance metrics and generating automated alerts for potential issues.

- Streamlining documentation and audits with digital records.

These solutions are especially beneficial for organizations facing complex compliance requirements or managing compliance across multiple regions or departments.

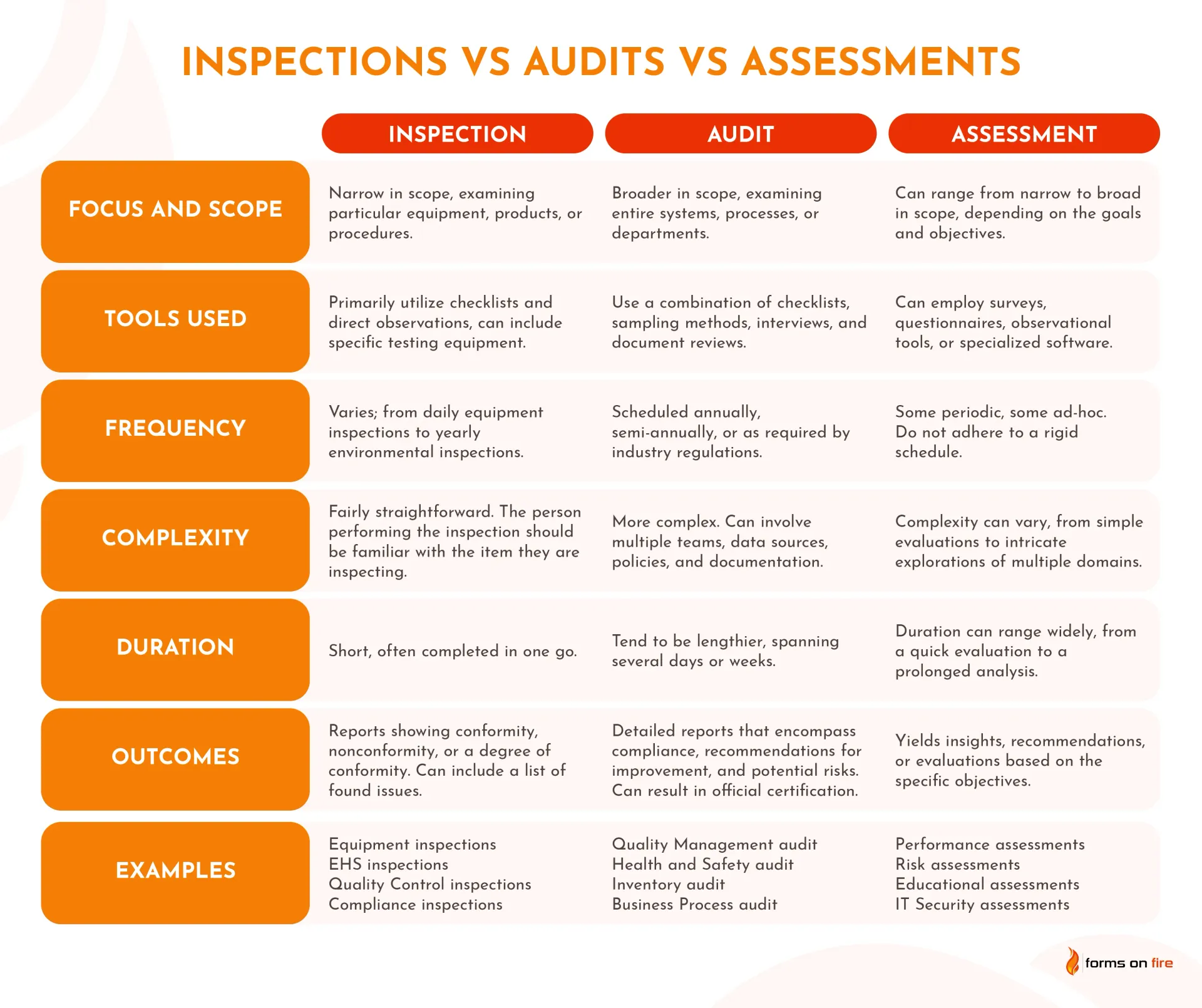

Conduct regular compliance audits and assessments

Regular inspections, audits, and assessments ensure that your compliance program is effective and up to date. These activities involve reviewing policies, procedures, and controls to identify gaps or areas of improvement.

Here’s what a streamlined compliance audit process might look like:

- Set a clear scope: Define what will be reviewed: whether it’s a specific regulation, department, or process.

- Use digital tools: Digital data collection forms and checklists can standardize the audit process, ensuring consistency and saving time.

- Document findings: Keep detailed records of audit results and recommendations for improvement.

- Follow up: Address identified issues promptly, updating controls or retraining employees as needed.

Conducting audits regularly ensures that compliance risks are identified and mitigated proactively. It also provides a clear trail of evidence that your organization is taking compliance seriously, which is invaluable during regulatory inspections.

Train employees on compliance requirements and responsibilities

Employees are a critical part of your compliance ecosystem. Regular training ensures that everyone understands their role in maintaining compliance and helps to build a culture of accountability.

An effective training program should include:

- Role-specific guidelines: Tailor training to the specific responsibilities of each team, from data handling to workplace safety.

- Clear communication: Use simple, jargon-free language to explain compliance requirements and why they matter.

- Interactive formats: Incorporate activities like workshops, quizzes, or simulations to reinforce learning.

- Regular refreshers: Keep employees up to date with periodic training sessions to cover new regulations or updates to internal policies.

To make training more effective, consider leveraging e-learning platforms or compliance software that can track progress and ensure every employee is equipped with the knowledge they need.

Integrate compliance into business processes

Compliance should not be treated as a standalone task. It should be embedded into your daily workflows — to ensure that regulatory requirements are met without disrupting productivity.

Here’s how to make compliance a natural part of your processes:

- Map compliance to operations: Identify which regulations apply to specific workflows and ensure those requirements are embedded into routine tasks. Incorporate compliance into your Standard Operating Procedures (SOPs) and similar materials.

- Automate where possible: Use software tools to incorporate compliance checks into everyday activities, such as approvals or data processing.

- Empower employees: Provide teams with accessible resources, such as guides or digital checklists, to make compliance easy to follow.

- Monitor continuously: If we are talking about something like IT compliance, you integrate real-time monitoring systems to identify potential issues before they become larger problems.

Digitize your controls to make following best practices easy

Digitizing your compliance controls — think policies, procedures, and audits — is a great way to streamline operations and facilitate compliance across your organization.

Digitizing controls offers numerous advantages:

- Accessibility: Employees can easily access up-to-date compliance documentation anytime, anywhere.

- Efficiency: Automated systems reduce the time and effort required for audits, reporting, and monitoring.

- Accuracy: Digital tools minimize the risk of human error, ensuring data is consistent and reliable.

- Scalability: As your organization grows, digital systems can adapt to support increased complexity and regulatory demands.

Forms On Fire is a no-code platform that simplifies this digitization process. Our database contains hundreds of different templates you can use to build custom digital forms and checklists.

Organizations use it to collect data, streamline audits and inspections, digitize processes, create workflow automation, and simplify reporting.

A tool like Forms On Fire enables you to start small, with a single process or audit type, and expand it across multiple departments and locations. You can start with a simple risk assessment or other GRC form and build it into a custom compliance management system.

Ready to start transforming compliance management? Schedule a demo today to see how Forms On Fire can support your compliance efforts.